Such as, let’s suppose that a cards also provides 0% intro APRs for nine weeks, followed by sells a keen 18% Annual percentage rate. We are going to think that in January your charge $10,one hundred thousand to your card for home improvements. Shortly after September, almost any remains into cards will start accruing notice. Very, for folks who repay just about $five-hundred, new $500 harmony manage start accruing demand for Oct. That’s apparently straightforward — it’s just how you’ll predict a short-term 0% intro Annual percentage rate promote to work. You only pay no appeal into the very first 9 days, following you have to pay attention towards any type of balance remains.

Many zero-desire financing even offers pitched by build and you may do it yourself businesses can also be charges what is called „retroactive notice“ or even repay the bill completely by prevent of one’s advertising months.

We shall assume that into the January you fees $10,one hundred thousand for the credit otherwise mortgage to own home improvements. Whenever October rolls around, unless of course what you owe is $0, you’ll be energized 18% yearly interest with the any monthly stability out of January to help you September, that’ll total up to more $step 1,100. Additionally feel billed focus with the one balance you’ve not reduced off moving forward.

Such, why don’t we suppose that a credit otherwise mortgage also offers zero attention to have 9 weeks, but if not costs an annual percentage rate regarding 18%

- You can easily shell out a regular interest to the equilibrium. If you intend to bring the balance toward credit cards from the a typical Apr from 18% or higher, forget about they. Settling a great $10,000 charge card equilibrium more 5 years from the an enthusiastic 18% Apr carry out set you back over $5,236 in the appeal. Unless of course your roof are leaking or if you enjoys cigarette developing of your fuse field, the home improvements often will wait. Begin setting aside money in a top-appeal family savings to pay for the new repair inside the cash. It does not make sense to invest fifty% alot more to possess a home repair today whenever you just wait and cut the cash you have to do it.

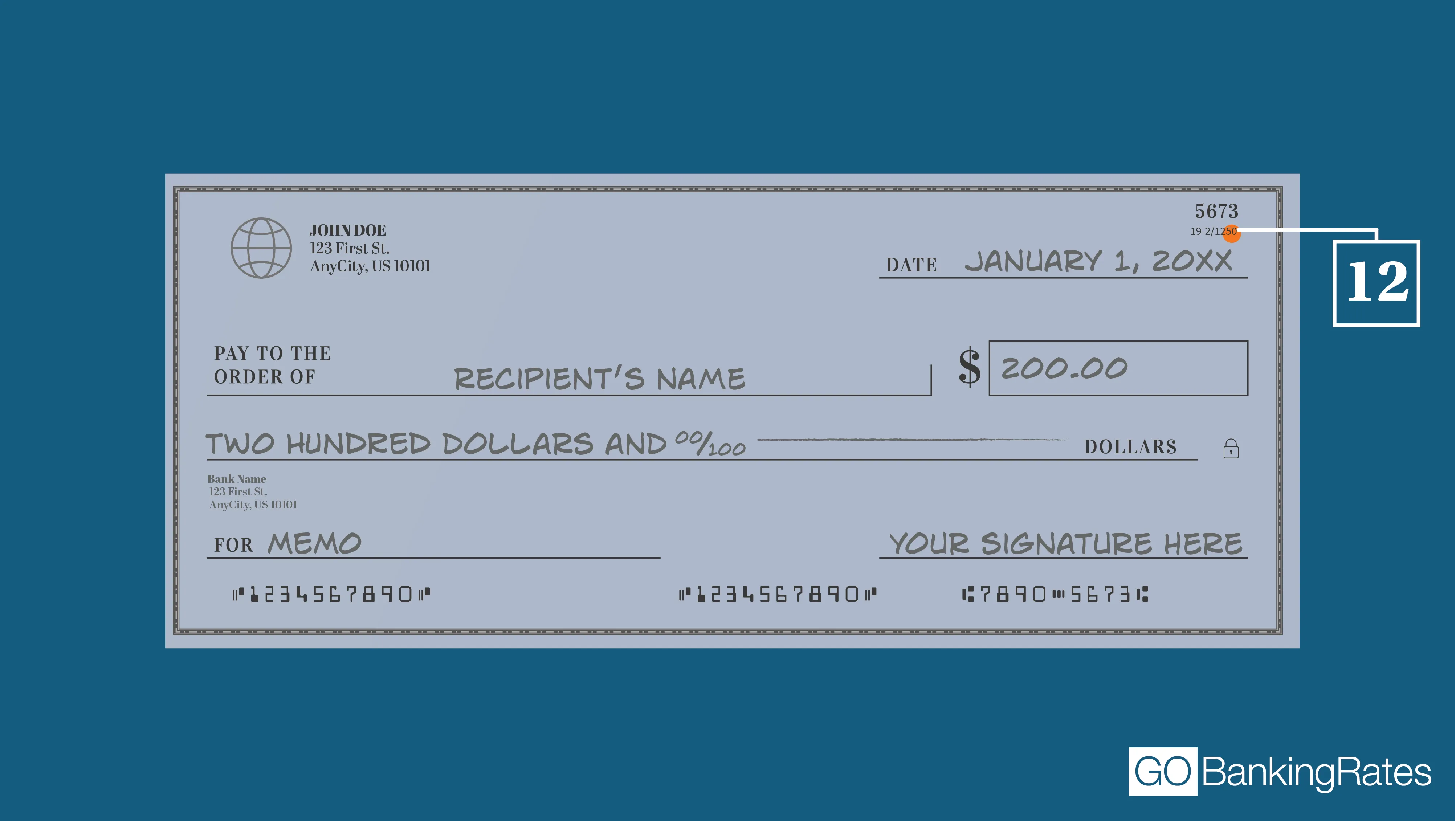

- You should buy a cost savings to have using within the bucks. Designers and you will home improvement businesses spend steep charges to just accept credit notes, have a tendency to 2% to help you 4% of your number recharged to a card. For this reason, of many contractors will give you a finances disregard to own expenses having dollars, evaluate, currency acquisition, otherwise financial cable. Whenever you rating a money discount, it merely makes sense to expend by credit card in case the rewards you have made for the card exceed this new disregard. Never pay step 3% even more to make use of a charge card on what you earn 2% cash return, such as for instance.

- You’ve got most other financial support choice. Outside of marketing 0% introduction APRs, playing cards have been the most expensive means to fix borrow. Creditworthy residents would realize that capable score an individual financing in the a lowered interest rate than just credit cards, and you may make the most of installment terms and conditions which can be so long as half dozen ages. On top of that, property security personal line of credit is an ideal way to finance a renovation, because interest payday loan Gulf Shores rates usually are super-low (just a little significantly more than mortgage pricing) and the notice should be tax deductible, in the place of mastercard or consumer loan attention.

Once you see a 0% introduction Apr for an over-all goal charge card (a credit which you can use anyplace), it’s almost always a real 0% introduction Apr provide for the duration of the marketing and advertising several months

Yes, even though you lower $nine,999 of the $10,100000 equilibrium when you look at the marketing and advertising several months, you are billed attention with the your stability retroactively. The only method to prevent paying interest with these „no attract“ also provides would be to shell out your debts down to $0 by the end of your marketing and advertising months.