Conventional cash flow is a useful tool to simplify the cash flow pattern and to evaluate and compare different projects using various methods. However, you should also be aware of the limitations and assumptions of these methods and use them with caution and judgment. Remember that the ultimate goal of capital budgeting is to create value for the shareholders and the society.

Understanding an Unconventional Cash Flow

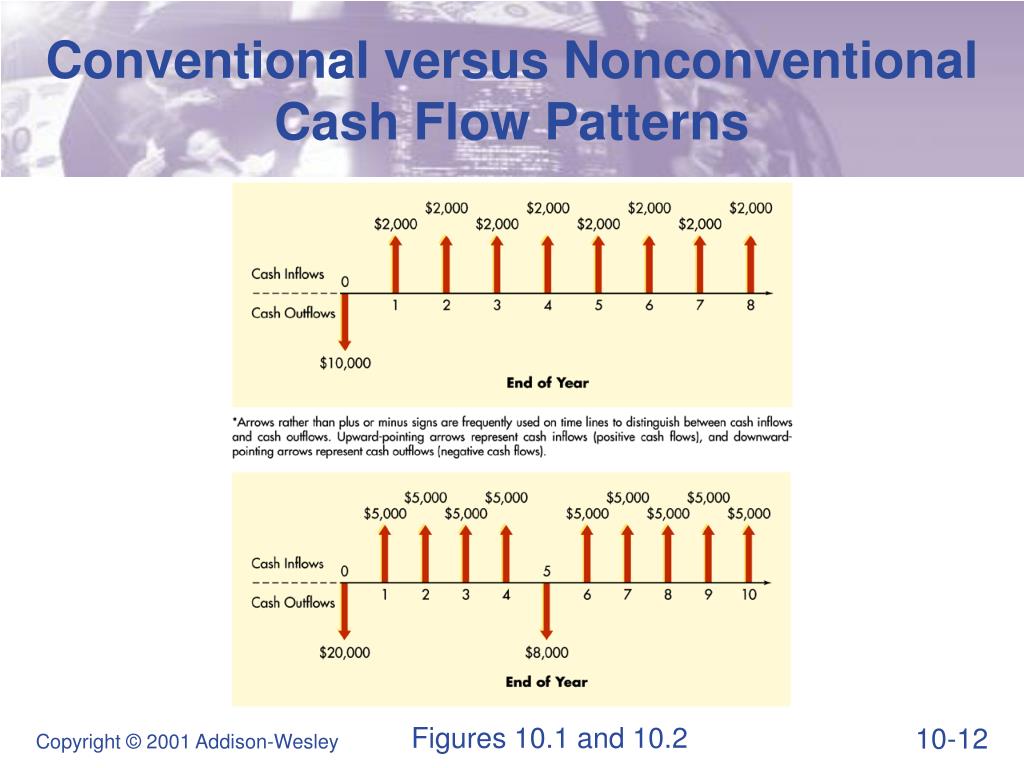

In real-life situations, examples of unconventional cash flows are abundant, especially in large projects where periodic maintenance may involve huge outlays of capital. A project with a conventional cash flow starts with a negative cash flow (investment period), where there is only one outflow of cash, the initial investment. This is followed by successive periods of positive cash flows where all the cash flows are inflows, which are the revenues from the project.

Do you own a business?

Companies with strong financial flexibility fare better, especially when the economy experiences a downturn, by avoiding the costs of financial distress. The conventional cash flow method is often used, but it has limitations and difficulties. It doesn’t capture the dynamic nature of cash flows and relies too much on past data to predict future ones. Plus, it doesn’t take into account the timing of cash flows, making it hard to assess an investment’s real value.

Unconventional vs. Conventional Cash Flows

Negative cash flow from investing activities might be due to significant amounts of cash being invested in the company, such as research and development (R&D), and is not always a warning sign. It is calculated by taking cash received from sales and subtracting operating expenses that were paid in cash for the period. To keep cash flow healthy, businesses can reduce accounts receivable collection times with discounts for early payments or use specialized agencies for collections. Also, negotiate payment terms with suppliers to delay outgoing payments without damaging relationships. Explore the significance of cash flow and its role in analyzing financial performance. Realizing the basics of cash flow is just like knowing the basics of breathing – it’s a must for survival, but sometimes it takes a desperate breath to recognize how essential it is.

How do you handle non-conventional cash flows in NPV analysis?

In history, cash flow surfaced with the improvement of financial management practices. As businesses became more intricate & global, understanding how money moved within an organization became very important. This led to the creation of techniques to analyze & translate this essential data precisely. Positive cash flow means a business has enough to cover costs, repay debts, and give out profits. This type of cash flow is used to measure a project’s gains and financial stability. By looking at the amount and timing of cash flows, investors can see if an investment is good or not.

Advantages and Limitations of Conventional Cash Flow Analysis

- The metric can provide a general overview of a company’s financial status and help to predict future cash flows.

- On top of that, non-monetary costs and benefits aren’t taken into account.

- It’s not random or inconsistent – it follows a path with set intervals, which makes it easier to plan and evaluate the financial success of the project.

- Deposits, from revenues that are made to repay the bank financing, are recorded as cash inflow.

- Proceeds from issuing long-term debt, debt repayments, and dividends paid out are accounted for in the cash flow from financing activities section.

- Despite high revenue figures, they suffered from liquidity issues due to slow-paying customers and excessive debt servicing costs.

The following cash flows series illustrate the difference between conventional and non-conventional pattern of cash flows. Conversely, lower levels of risk and uncertainty lead to lower discount rates and higher present values. We can see that project B has a unique and positive discounted payback period, which is less than the maximum acceptable payback period of 3 years, meaning that it is also acceptable and liquid. However, project A still has a lower discounted payback period than project B, meaning that it is more preferable.

Thank you for reading this blog and we hope you have learned something valuable from it. C is incorrect because a current portion of long term debt cpltd pattern (not a nonconventional cash flow pattern) is the one which has an initial cash outflow followed by a series of cash inflows. Conventional cash flow is the usual pattern of in and out money in a business or investment. It starts with an initial cost, next are series of positive cash flows, at last, a final negative cash flow. Conventional Cash Flows (CCFs) are defined as a series of inflows and outflows, with an initial outlay at the beginning followed by only cash inflows afterward. In the process, the cash flow pattern changes its direction only once and keeps proceeding in that direction.

To pay for the new office, the company borrows a certain amount of money from the bank. The money that the bank puts into the company’s account is a cash inflow. This means that the current value of the $10,000 expected in five years is $7,835.26, considering the time value of money and the 5% discount rate. The time value of money is a fundamental concept in finance, which states that money available at the present time is worth more than the same amount in the future. Below is Walmart’s (WMT) cash flow statement for the fiscal year ending on Jan. 31, 2024. CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation.

Now, if a project was to be subjected to other cash outflows in the future, it will lead to two or more IRRs. The practice makes it challenging to evaluate the project and come up with a decision. For example, if the two IRRs stand at 8% and 16%, respectively, yet the hurdle rate is 12%, the management or investors will not want to undertake the project because of uncertainty. For a practical example, consider Nina, who invested $100,000 in a private firm in 2017, acquiring a 10% equity stake.

CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path. Another circumstance that may cause mutually exclusive projects to be ranked differently according to NPV and IRR criteria is the scale or size of the project. In other words, positive NPV investments are wealth increasing, while negative NPV investments are wealth decreasing. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

PV is calculated by taking the future sum of money and discounting it by a specific rate of return or interest rate. This discount rate takes into account the time value of money, which means that money today is worth more than the same amount of money in the future. A student is considering pursuing a master’s degree in finance that costs $50,000 in tuition and fees and takes 2 years to complete. The student expects to earn $60,000 per year after graduation for 10 years. The student’s opportunity cost of capital is 8%, which is the rate of return that the student could earn by investing the money elsewhere or working instead of studying.