Most of the time, this signals that the management has prioritized investment in collections and improved the collections processes. Alternatively, you can divide the number of days in a year by the receivables turnover ratio calculated previously. To find how long it takes for Rosie Dresses to collect the money its customers need to pay for the goods already purchased, we will divide the annual sales of $2,650,000 by 365 to get $7,260. Implementing detailed reporting mechanisms provides insight into payment patterns and identifies troubling trends with specific accounts.

What Is Average Collection Period? – Formula and How to Calculate It

Net credit sales are calculated as total sales made on credit minus any discounts or returns during the same period. The average collection period is the time a company takes to convert its credit sales (accounts receivables) into cash. It provides liquidity to the company to meet its short-term needs or current expenses as and when they become due.

Compared to Current Credit Terms

- This will help your company nail its cash flow targets and ensure you don’t end up in a cash flow crunch.

- It provides liquidity to the company to meet its short-term needs or current expenses as and when they become due.

- To really understand your accounts receivables, you need to look at this metric in tandem with related metrics like AR turnover, AR aging, days payable outstanding (DPO), and more.

- You should always be monitoring your cash solvency so that you are sure you have enough capital available to take care of your financial responsibilities.

- The direct relationship between average collection period and cash flow is straightforward.

The cycle is calculated by adding the average sale period (or inventory days) and the average collection period (or accounts receivable days). The average collection period is the time it takes for a business to collect payments from its customers after a sale has been made. Businesses aim for a lower average collection period to ensure they have enough cash to cover their expenses.

Predicting Cash Flow and Planning for Future Costs

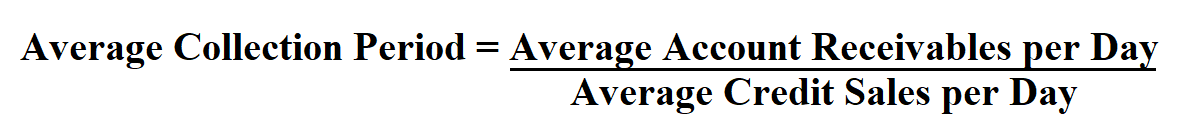

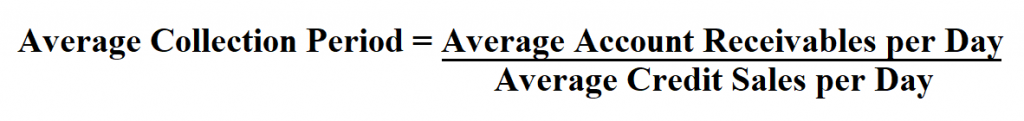

However, it may also imply stricter credit terms which could deter potential customers seeking more lenient payment terms. Average collection period is a company’s average time to convert its trade receivables into cash. It can be calculated by dividing 365 (days) by the accounts receivable turnover ratio or average accounts convert from xero to qbo has anyone done this receivable per day divided by average credit sales per day. The operating cycle, also known as the cash conversion cycle, is important to understanding a company’s cash flow and working capital management. It represents the time taken for a company to convert inventory into sales and collect cash from those sales.

As many professional service businesses are aware, economic trends play a role in your collection period. Seasonal fluctuations impact payment behaviors, which in turn affect your average collection period. According to the Bank for Canadian Entrepreneurs (BDC), most businesses should have an average collection period of less than 60 days. However, the ideal number depends on the nature of your business, client relationships, and invoice period.

Analyze Payment Terms and Policies

However, it also means that they follow a very strict collection procedure which may also drive away customers because they prefer suppliers who have more flexible credit terms. The average collection period is the timea company’s receivables can be converted to cash. It refers to how quickly the customers who bought goods on credit can pay back the supplier.

Business owners and managers must closely monitor the metric to ensure that the company has enough cash available to cover its short-term financial obligations. In this article, we are going to take a look at how to calculate and analyze the average collection period. If a business offers a 30-day credit term, an average collection period near or below 30 days is often seen as efficient. This timely turn-around keeps cash flows steady and can indicate a strong collection process.

This type of evaluation, in business accounting, is known as accounts receivables turnover. You can calculate it by dividing your net credit sales and the average accounts receivable balance. Alternatively, check the receivables turnover ratio calculator, which may help you understand this metric. The “average collection period” is a financial metric that represents the average number of days it takes for a company to convert its accounts receivables into cash.

If a company has a longer average collection period, it means its cash inflow is slower, potentially leading to cash crunches, especially for small and medium-sized businesses. This situation could stall necessary business operations, such as purchasing raw materials, paying salaries, or investing in business growth. If you have a low average collection period, customers take a shorter time to pay their bills.

If you have a high average collection period, your corporation will have to deal with a smaller amount of problems. For example, if a company has an ACP of 50 days but issues invoices with a 60-day due date, then the ACP is reasonable. On the other hand, if the same company issues invoices with a 30-day due date, an ACP of 50 days would be considered very high. It’s essential to consider the industry average and whether the nature of the business requires longer terms to remain competitive.

Additionally, extended payment terms may lead to customers feeling neglected or overlooked. Let’s examine how an average collection period of 30 days compares with one of 60 days in a given industry. Companies with a 30-day average collection period are perceived as having more efficient AR management practices, while those with a 60-day average collection period may appear less so.