Implementing Intra-Relatives Mortgages

One of the greatest pressures for many parents offered intra-loved ones finance – for example intra-family mortgage loans – is only the management works and needs to-do the borrowed funds safely, specifically given that financing must be properly recorded from the residence on appeal to-be allowable on borrower (and you can significantly, clear records of financing is additionally called for if for example the bank ever before desires an income tax deduction for amounts not paid off about feel the brand new borrower defaults).

On the other hand, specific parents in fact prefer a far more specialized financing arrangement; by way of example, in the event the mothers-as-lenders really would want the order as financing (and never a masked provide), they want to verify the little one-as-borrower areas they appropriately and finds out specific monetary obligations (albeit while you are however viewing alot more beneficial mortgage terms and conditions than just would-be acquired away from a bank, and keeping the borrowed funds interest in your family). Alternatively, in case the cash is being loaned out of a household trust, the newest trustee will most likely wish to have the loan becoming safely noted and you may filed to help you establish one to fiduciary personal debt to manage brand new believe corpus responsibly are found.

A fascinating this new solution within this place is National Family members Mortgage, a company that functions as the latest „middle son“ to aid processes and continue maintaining intra-household members mortgage loans, approaching anything from creating up the promissory note between your activities, documenting this new action out-of faith one to pledges the house or property because security and you may recording it from the right legislation, establishing digital loans import plans having financing payments (and additionally escrow having home insurance and possessions income tax, in the event that wanted) and you may sending out percentage sees and you may balance comments, and even giving the proper Internal revenue service reporting versions (the shape 1098 into borrower getting mortgage attention paid down, plus the Function 1099-INT to your lender getting desire obtained). In case the mortgage is organized due to the fact appeal-simply, the new National Friends Financial service may also be helpful arrange for good portion of the loan to get forgiven per year (which is far less going to bring about Internal revenue service analysis whenever notice will be repaid, loan data try filed, as well as additional conformity of the transaction are increasingly being respected).

The cost into the solution was a one-big date percentage between $725 and you may $2,one hundred (according to the sized the borrowed funds) into financing data files (hence, rather, tends to be nonetheless way less versus origination percentage for a great old-fashioned financial!), a supplementary recording income tax paid off straight to the state/condition (to have jurisdictions that need they), and continuing financing maintenance (towards comments, digital loans transfer, Internal revenue service revealing, etc.) will cost you $15/week (otherwise quite a great deal more getting larger money, with an additional $15/times charge getting escrow attributes). Website subscribers with the blog is receive a good fifteen% discount to the that-go out payment the of the customers which make use of the services because of the entering the promotional code „KitcesBlogDeal“ (without having any estimates) if the visitors signs up. (Editor’s Notice: This is just a complimentary render so you can website subscribers of this writings; there is no economic remuneration and other relationship between Nerd’s Vision Examine and you will Federal Friends Mortgage.)

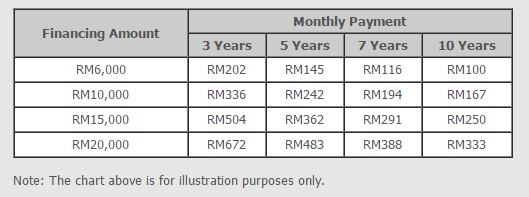

Because of this, intra-family unit members mortgage loans may still become most enticing since credit rates, even if the cost must become „high enough“ in order to satisfy the brand new IRS‘ AFR conditions

www.availableloan.net/personal-loans-ut/kingston/

Fundamentally, intra-family relations mortgage loans are a pretty „niche“ means, whilst need particular tall monetary wherewithal on relatives in order to spend the money for financing to pupils or any other family in the first place. However, services such as for example Federal Nearest and dearest Mortgage improve processes rather more straightforward to pertain and you will administer, as well as a fees which is however much less compared to origination percentage to own a traditional financial, while as well continue all lingering interest costs about family relations. And also at the current Relevant Federal Pricing, there are many window of opportunity for mothers to greatly help pupils or other loved ones build home orders cheaper, whilst creating what exactly is nevertheless a reasonable come back provided the current lower get back ecosystem!

Yet another advantageous asset of intra-nearest and dearest financing, specifically since home financing for purchasing a house, is that a number of the restrictions out of traditional financing underwriting is actually not any longer an issue; for example, loved ones won’t need to charges so much more to own a kid which have a bad credit score, and certainly will easily provide money as much as 100% of the purchase price in place of requiring an advance payment. The mortgage will be getting a primary get, otherwise a good refinance, or a repair, and could feel arranged as the a second otherwise third lien resistant to the family. That prominent strategy is for the kids in order to borrow doing 80% playing with a timeless home loan to have a separate house get, but borrow money out of mothers to cover the fresh down-payment with the kept 20% (recorded because an extra lien to the home).

What exactly is known, regardless of if, is that as the Relevant Federal Cost are thought „ily mortgage attention at this cost stops gift cures, he’s still remarkably positive rates; lately, the fresh small-term price could have been one/fourth of just one%, the newest mid-name speed is below 1%, as well as this new enough time-label rate was less than 2.5%! 8% (since committed associated with writing), and a 30-12 months financial is close to step three.5%.