Rent falls under operating expenses, while product costs like labor and materials are used to calculate COGS. Tracking the difference helps with managerial decision making and financial reporting. Period costs are not assigned to one particular product or the cost of inventory like product costs. Therefore, period costs are listed as an expense in the accounting period in which they occurred.

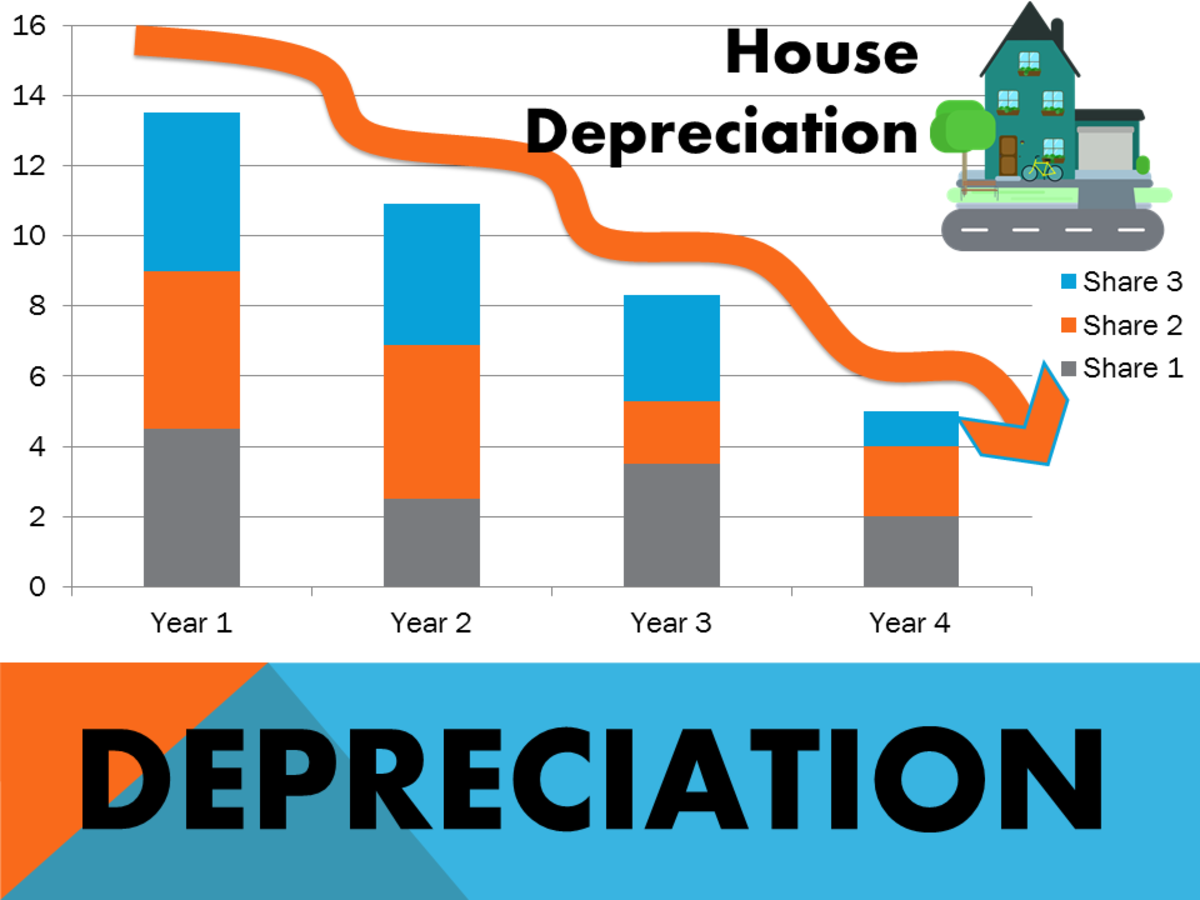

Careful monitoring of period costs is key for businesses to control operating budgets. Period and product costs play different but important roles in financial reporting. As a non-cash expense, depreciation appears on the income statement but does not directly drain cash flow. While variable costs like materials rise and fall with production volume, fixed expenses like depreciation, rent, insurance, etc. remain unchanged from month to month.

What is your current financial priority?

The key difference is product costs can be traced to specific units produced, while period costs cannot. Every cost incurred by a business can be classified as either a period cost or a product cost. A product cost is incurred during the manufacture of a product, while a period cost is usually incurred over a period of time, irrespective of any manufacturing activity. A product cost is initially recorded as inventory, which is stated on the balance sheet. Once the inventory is sold or otherwise disposed of, it is charged to the cost of goods sold on the income statement.

Product Costs and Cost of Goods Sold (COGS): Inventory Valuation

These costs should be monitored closely so managers can find ways to reduce the amount paid when possible. During the fourth quarter of 2016, Company XYZ expected to pay $150,000 in rent and utilities and $100,000 in insurance and property taxes. Period expenses are usually calculated by adding together all expected payments for a period, then subtracting any amounts that were paid early. Discover the top 5 best practices for successful accounting talent offshoring. We’re a headhunter agency that connects US businesses with elite LATAM professionals who integrate seamlessly as remote team members — aligned to US time zones, cutting overhead by 70%. Rent expense is often a monthly amount paid by a company for use of a building.

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy. As a general rule, costs are recognized as expenses on the income statement in the period that the benefit was derived from the cost. So if you pay for two years of liability insurance, it wouldn’t be good to claim all of that expense in the period the bill was paid. Since the expense covers a two year period, it should be recognized over both years. In some cases, it will be too expensive for a company to eliminate certain types of period costs from its operations.

Examples include administrative salaries, marketing, research and development (R&D), etc. For example, a manufacturer may pay $5,000 per month in rent for its factory. The rent expense is recorded on the income statement each month whether 1,000 units or 10,000 units are manufactured.

- It is important to understand through the accrual method of accounting, that expenses and income should be recognized when incurred, not necessarily when they are paid or cash received.

- Tracking the difference helps with managerial decision making and financial reporting.

- These costs are not included as part of the cost of either purchased or manufactured goods, but are recorded as expenses on the income statement in the period they are incurred.

- During the fourth quarter of 2016, Company XYZ expected to pay $150,000 in rent and utilities and $100,000 in insurance and property taxes.

The articles and research support materials available on this site are educational and are not intended to be investment or is rent a period cost tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. In these cases, a more feasible alternative is to try and reduce the amount paid in earlier years. What remains is the total amount of expected expenditures during the period. Learn about emerging trends and how staffing agencies can help you secure top accounting jobs of the future.

Period costs:

For example, if a bakery miscategorized electricity costs as a product cost rather than period cost, it would overstate the breakeven point for selling baked goods – leading to inefficient business choices. Production costs are usually part of the variable costs of business because the amount spent will vary in proportion to the amount produced. However, the costs of machinery and operational spaces are likely to be fixed proportions of this, and these may well appear under a fixed cost heading or be recorded as depreciation on a separate accounting sheet. Product costs are often treated as inventory and are referred to as „inventoriable costs“ because these costs are used to value the inventory. When products are sold, the product costs become part of costs of goods sold as shown in the income statement.

Overhead or sales, general, and administrative (SG&A) costs are considered period costs. SG&A includes costs of the corporate office, selling, marketing, and the overall administration of company business. If the related products are sold at once, then these costs are charged to the cost of goods sold immediately. If the products are not sold right away, then these costs are instead capitalized into the cost of inventory, and will be charged to expense later, when the products are eventually sold.