Better 2nd home loan cost inside Ontario:

There are many different gurus which is often of the refinancing and taking out an additional financial. Regarding taking out fully next mortgage loans into the attributes getting the purpose of with these people as a form of debt consolidation reduction financing, the newest debtor shall be protecting many, and perhaps a large number of dollars per year on the focus can cost you and you can monthly loans money toward best integration loan.

What if which you have amassed $a hundred,100000 for the combined personal credit card Silver Cliff loans debt because you reside in a costly urban area such as Toronto and employ handmade cards to collect points that you can later on have fun with for various some thing. You opt to use the second home loan to pay off your playing cards and combine every monthly obligations into the that unmarried faster payment. Imagine if that the mediocre rate of interest on your playing cards try 20% (that is actually a common interest into the of numerous borrowing cards available). Within a fixed 20% notice, you will be investing $20,100 inside the focus per year for individuals who sent the full $100,000 equilibrium on the season. Your own lowest monthly payment would likely feel up to 2% of balance per month (focus + a little bit of principal) which will become $2,one hundred thousand 1 month. At this rate it might take you more than 9 age to help you pay back new $100,100000 at this price, so long as that you do not purchase an extra money on the borrowing notes.

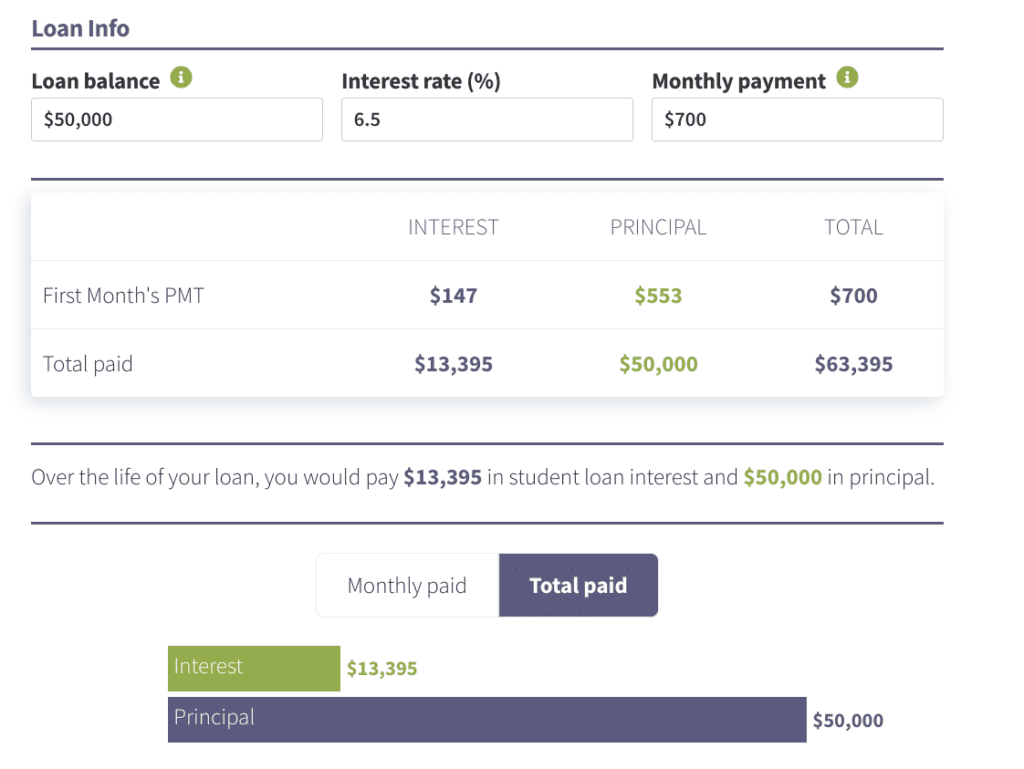

Whenever we bring one to same $one hundred,100000 and be they towards the a 2nd mortgage, then you can be investing only 5.99%* a year having approximately dos.5% in lender costs and you will 2.5% in the representative fees reduced initial or deducted from the financing progress. This is exactly providing you really have lot out-of collateral available of your property and this is found in good town or even more populated area such as for instance Toronto, if not faster towns and cities like Kitchener, London Ontario, Cambridge, Kingston, Barrie, and other also inhabited places. Inside circumstances, your own monthly installments is $ every month, which is $step one,500 less than is you were and work out the minimal monthly borrowing from the bank credit payments. For individuals who place you to more $step 1,five hundred on the paying down the main level of $one hundred,100000, then you definitely could pay it back inside because little given that five years and you will eight days. You would certainly be repaying your debt during the a much faster rate and you will saving more than three years off monthly payments within scenario. These types of scenario have a tendency to work well from the homeowner’s rather have.

* Annual percentage rate off % along with every estimated costs and you can focus. This is basically the undertaking interest at that time these pages was made inside which is predicated on a decreased loan-to-worth. Annual percentage rate may differ according to several items in addition to, not limited by, loan-to-value, location, credit score, money verification, and a lot more. Interest levels was at the mercy of transform with no warning any moment.

Thus they will certainly keep back the monthly installments and you may include it with the full loan amount

Knowing one cashflow and you will expenditures was a real condition for you, upcoming of numerous individual lenders would be happy to keep back an attention put aside whenever refinancing your house which have an additional mortgage. Thus, you will never have to make people monthly installments, however you will getting expenses a whole lot more during the notice consequently, as the price will remain a comparable.

Such as for example, can you imagine you’ve got property from the greater Toronto city and require to carry out a beneficial $one hundred,100 second mortgage plus monthly payments manage turn out in order to $five hundred monthly ($six,100 towards year), however lack sufficient available income to help you services and shell out that matter per month. Exactly what the financial ount regarding the complete amount borrowed and you can often only improve your $94,100, otherwise might advance the complete $a hundred,one hundred thousand if you want they, however you will upcoming are obligated to pay him or her straight back $106,000 during the prominent. This all assumes you have adequate collateral on the assets to allow the lender to finance and you may give you which matter.