The new and you will Unexpected Personal debt

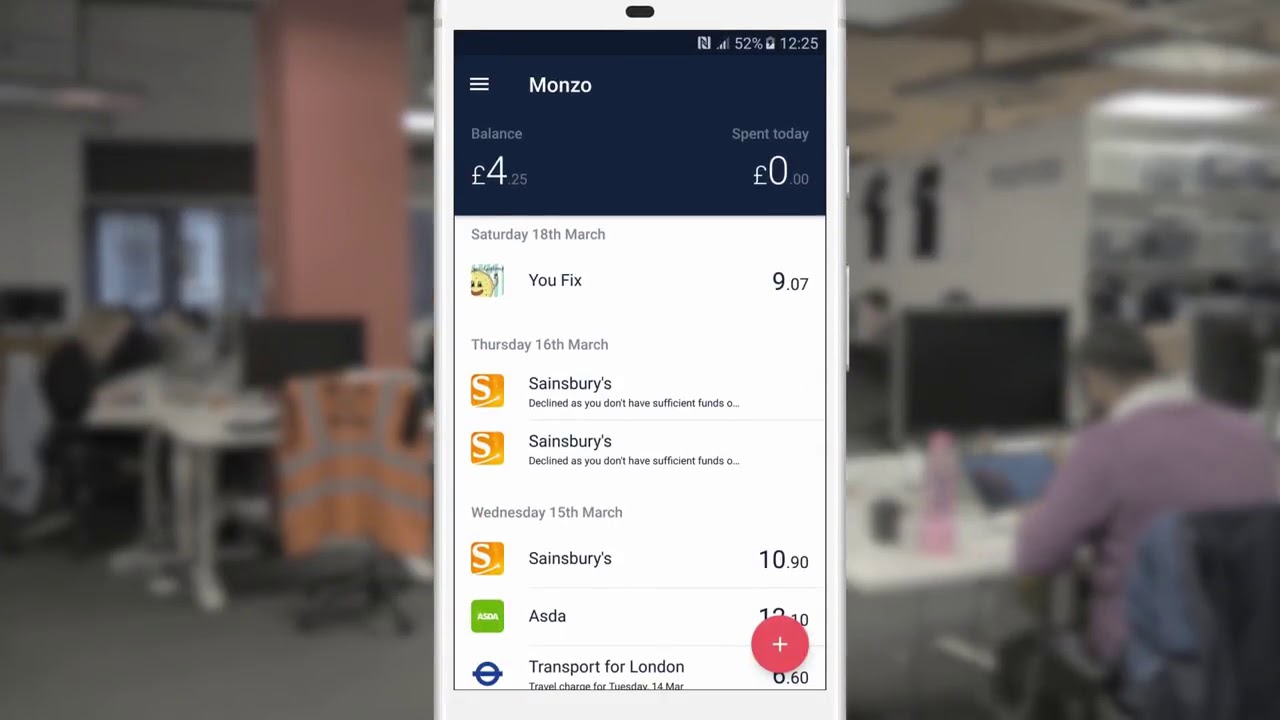

Several other popular reason for lenders in order to refute home financing pursuing the an effective pre-approval is because the debtor provides procured a sophisticated off personal debt. In the go out one which just finish their financial and you may house get, you really need to refrain from trying out anymore loans than your actually have. Actually a little upsurge in loans otherwise a separate collection of borrowing from the bank you’ll place your financial pre-acceptance in danger. A rise towards the financial obligation, it doesn’t matter what unimportant, changes your debt-to-money ratio and you may end in their home loan are rejected.

Before you tray up your credit card or take out a beneficial the new financing, it is recommended that your check with your large financial company regarding the the selection. Good large financial company have a tendency to always suggest that you waiting until the files was signed before generally making one sudden financial actions.

Bank Tip Transform or The new Standards

It is essential to remember that though a borrower has actually started pre-approved by their bank, they are certainly not exempt of one the assistance otherwise requirements one government entities or private lenders apply. When the a loan provider alter the lowest credit requisite from 600 so you can 620, individuals that have a lesser credit history will lose its home loan pre-acceptance. Even though this may sound frustrating, a great large financial company is able to find you recognized which have another financial whose constraints was a Augusta installment loan with savings account little other.

Most other changes in order to bank criteria otherwise qualification advice that will produce their home loan to be denied just after pre-acceptance is obligations to help you earnings tip changes and variations into the number of deals questioned of a purchaser.

The new Appraisal Is available in Too Lowest

When you’re buying a home from the newest builder, compared to most cases it’s not necessary to have the domestic appraised, as well as the banking institutions will give you a mortgage loan mainly based toward price that you will be spending money on it. If you’re to buy good pre-current otherwise pre-lived-in household, following more often than not the mortgage lender will demand an assessment you to is performed by the a certified appraiser of your lender’s options.

Unforeseen exterior circumstances in this way have demostrated as to why individuals should always really works that have a mortgage broker and you may community professional who’ll help them browse like unanticipated points.

A common concern that’s questioned of the consumers is how they normally be sure the mortgage doesn’t get refused adopting the their pre-acceptance. It may seem stupid, however the best solution is always to keep doing what you was indeed starting before you can pre-recognition. Because you currently got acknowledged to possess home financing, all you need to manage are stay in an equivalent financial reputation as you did prior to your pre-recognition. A mortgage pre-recognition usually lasts for 120 weeks which means that your work while the a great debtor would be to maintain your profit regular until you buy your household. Mortgage lenders and you will lenders will do all things in its strength observe as many of their pre-approvals get to closing, so that you won’t need to works too hard.

Here are some even more tricks for consumers which need to make sure their mortgage will not rating refused last minute:

- Never make large places into the bank accounts over the last ninety in order to 120 weeks ahead of the financial stems from romantic and you will financing with out evidence about where in actuality the currency emerged from

- Never withdraw large amounts of money from your own bank account contained in this you to same time period

- Dont accept most other credit lines, the newest playing cards, new car loans, or other types of financing

- Dont accrue so much more expense by the holding a higher balance in your present handmade cards