- Posts

- Financial Information

- Just how Peer-To-Fellow Funds Functions? Know-all From the P2P Credit

If you like a loan, the initial choice that will visited your mind is to check out a lender otherwise an enthusiastic NBFC. Yes, these are certainly legitimate options, but now, individuals keeps possibilities beyond the traditional bank operating system. One such option is fellow-to-peer (P2P) funds, in which you have the option to borrow money directly from investors or loan providers into the programs. You could get funds within surprisingly lowest cost and with an easy application techniques. Why don’t we have a look at exactly what fellow-to-fellow lending is focused on:

What is actually a peer-to-Peer Financing?

Either, you’re not eligible for a loan of financial institutions and you may NBFCs because your income is actually lower, you have got a low credit history, the latest records is actually inappropriate, or the interest rate try large. This kind of a situation, you could decide for peer-to-fellow credit. Peer-to-fellow credit takes banks and you can NBFCs outside of the financing process and you can allows people and you can businesses to help you borrow funds of people. P2P lending allows you to score that loan to invest in training, grow a business, refinance personal debt, etc. within a faster speed. In fact, in some cases, you could receive money in less than weekly.

Why does P2P lending really works?

Peer-to-peer lending normally happens over systems you to definitely hook up individuals and you will lenders really. If a person wants to lend currency to people and you will enterprises, it’s possible to check in to your a peer-to-fellow lending platform just like the a loan provider. If you’re looking to help you borrow P2P finance, you could potentially sign in to your particularly programs since a borrower. P2P networks look at you once the a debtor into the several variables. For example sites dont limit its evaluation to simply your borrowing get but look at your income, credit rating, employment updates, etcetera. To enable it, peer-to-fellow lending programs generate thorough entry to technology. They could get your credit or using models through application utilize, social network facts, etc. Centered on that same day instant funding installment loans. it option form of testing, your creditworthiness is set because of the program. Whenever you are entitled to credit, you are assigned to a threat bucket. Considering their chance bucket, an appropriate interest rate is determined for your requirements. If you find yourself in a lower-risk bucket (the working platform believes that you will not standard), youre offered that loan in the a reduced interest. However, for many who belong to a higher chance container, the interest rate you pay is large. If you are planning so you can provide currency, you’ll be able to observe some debtor options towards peer-to-fellow lending system. You might pick one or more consumers in line with the exposure we would like to simply take. If you want increased interest into share your lend, you could potentially give the bucks so you can large-chance borrowers, and the other way around. You will be curious the way the P2P platform winnings from its operations. Very fellow-to-fellow financing networks ask you for out of both the financial and new borrower for using the working platform. It must be listed that P2P platforms was RBI managed, and this implies that your money isnt held by P2P platform.

There can be chance of this very resource options hence is applicable so you can P2P lending also. The big risk that have fellow-to-peer credit is the standard chance of the borrower. Which is, the latest borrower ount and also the attention relevant to your loan. In this instance, the lending company stands to get rid of the whole sum lent. Which exposure is going to be handled because of the researching the danger character regarding new debtor really. The fresh P2P program typically has its analysis procedure. However, in case the credit platform’s technology is obsolete, it can’t precisely assess the borrowers‘ repayment potential, that may property loan providers from inside the a soup. In these instances, the lender could end upwards getting alot more risks than wanted. Thus, it is very important to expend long finding this new ideal peer-to-peer credit programs.

Key points to keep in mind when using a great P2P financing system

- The interest rate selections away from 10% in order to twenty-eight%, additionally the period could possibly get include ninety days in order to 36 months.

- All P2P platforms is controlled from the RBI. P2P platforms have to sign up for an enthusiastic NBFC-P2P license to add these services.

- A loan provider do not lay a total of more ?fifty Lakh round the this type of systems any kind of time considering area. Then, good lender’s experience of an equivalent debtor never exceed ?50,000 round the the P2Ps.

- Due to the fact a debtor, you aren’t allowed to borrow a maximum of over ?ten Lakh round the all of the P2P platforms.

- In the event that a debtor non-payments, P2P systems do not make sure dominating otherwise attention fees. Yet not, they may help in data recovery and you will filing an appropriate find against the latest debtor. Yet not, it will not make certain an optimistic benefit.

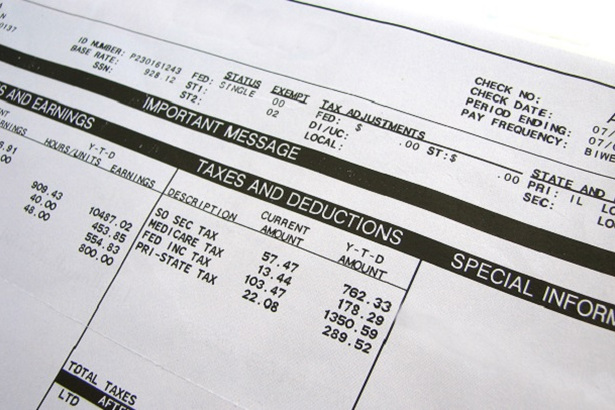

Taxation: P2P fund

Regarding the P2P mortgage process, a lender’s income were the attention generated towards the loan amount. So it notice attained out of P2P credit comes around ‚Income from other Sources‘ within the accounting words. It will be added to your earnings and you will taxed according to the taxation bracket. If you fall into the new 20% income tax class, you will have to pay a beneficial 20% tax on the focus won.

If you choose fellow-to-peer lending?

If you are investing in fixed places, the place you score 56% efficiency in the current situation, the opportunity to earn much more than ten% come back might look attractive which have P2P credit. But not, P2P financing is sold with a threat of losing the principal count throughout the terrible-situation circumstances. For the same reason, extremely traders consider it riskier than security expenditures. You can make use of this to blow a portion of the capital inside the high-risk financial investments having diversification. Once the a debtor, P2P money is a good option if you are unable to locate finance from conventional source. But, one which just move on to P2P financing, if you need financing, Poonawalla Fincorp has the benefit of a customized suite out of quick, transparent, and you can stress-free financing products. You could potentially take advantage of several fund instance Private Financing, Loans, etc. Link now!