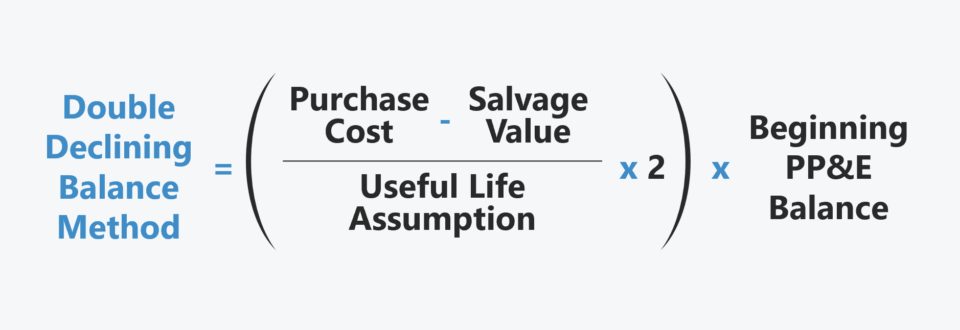

It can have a significant impact on profits if not taken into account. The term “double-declining balance” is due to this method depreciating an asset twice as fast as the straight-line method of depreciation. The “2” in the formula represents the acceleration of deprecation to twice the straight-line depreciation amount. However, when using the declining balance method of depreciation, an entity is not required to only accelerate depreciation by two.

Comparison with Other Depreciation Methods

Depreciation is a measure of how much of an asset’s value has been depleted over the depreciation schedule or period. Below we will describe each method and provide the formula used to calculate the periodic depreciation itsdeductible expense. The asset will accumulate 2.5 years of depreciation out of its total useful life of 5 years. We can simply multiply the annual depreciation amount by 2.5 to calculate the accumulated depreciation.

Easy-To-Use Platform

Depreciation accounting necessarily involves a continuous succession of journal entries to charge a fixed asset to the expense and, eventually, to derecognize it. These double entries are intended to reflect the continuous use of fixed assets over time. Deducting the cost of an asset from its salvage value gives us its depreciable amount which in this case is $5000. Dividing it by the annual depreciation expense ($1000) gives us the useful life in years. The amount of depreciation expense decreases in each year of an asset’s useful life under the straight line method. Depreciation expense in the year of acquiring an asset is the full year’s depreciation expense calculated using the straight line depreciation formula and multiplying that by the time factor.

Sum-of-the-Years’ Digits Method

The double-declining balance method results in higher depreciation expenses in the beginning of an asset’s life and lower depreciation expenses later. This method is used with assets that quickly lose value early in their useful life. A company may also choose to go with this method if it offers them tax or cash flow advantages. Now let’s look at the good way when we are using depreciation expense. Fixed assets, as learned in our cost lesson, are capitalized, put on our balance sheet as an asset. Purchasing the same airplane for $20,000,000 will now be entered into an equipment or fixed asset account, signifying asset ownership, with cash still going out.

The straight line depreciation method is the process of allocating the cost and the asset over its entire working period in equal amount. A fixed percentage is charged on the initial cost of the asset every year. Therefore, the asset value reduces uniformly, finally reaching its scrap value at the end of the useful life. Thus, the depreciation expense in the income statement remains the same for a particular asset over the period. As such, the income statement is expensed evenly, and so is the asset’s value on the balance sheet. The asset’s carrying amount on the balance sheet reduces by the same amount.

- Unlike the other methods, the units of production depreciation method does not depreciate the asset based on time passed, but on the units the asset produced throughout the period.

- This method is used with assets that quickly lose value early in their useful life.

- The initial cost of the fence was $25,000, and you think you can scrap the wood for $3,000 at the end of its useful life.

- It is calculated by simply dividing the cost of an asset, less its salvage value, by the useful life of the asset.

However, it’s primarily a cost allocation method, not measuring an asset’s operational efficiency or productivity. Understanding this distinction is crucial for accurate financial analysis and reporting. The straight-line method is advised also because it presents calculation most simply. It has a straightforward formula and an approach that reduces the occurrences of errors.

Then, divide that figure by the estimated useful life of the asset. While the purchase price of an asset is known, one must make assumptions regarding the salvage value and useful life. These numbers can be arrived at in several ways, but getting them wrong could be costly.

It prevents bias in situations when the pattern of economic benefits from an asset is hard to estimate. Cost of the asset is $2,000 whereas its residual value is expected to be $500. Lastly, let’s pretend you just bought property to build a new storefront for your bakery. You installed a fence around the entire plot of land, which falls under the 15-year property life. The initial cost of the fence was $25,000, and you think you can scrap the wood for $3,000 at the end of its useful life.

In this method, the companies expense twice the amount of the book value of the asset each year. The car cost Bill $10,000 and has an estimated useful life of 5 years, at the end of which it will have a resale value of $4000. Don’t worry if you’re wondering how each year’s depreciation charge was calculated above.

Straight line depreciation is an accounting method used to allocate the cost of a fixed asset over its expected useful life. It is calculated by dividing the cost of the asset, less its salvage value, by its useful life. This method is widely used because it is straightforward, and it helps organizations accurately reflect the value of their assets on financial statements.

If an asset is purchased halfway into an accounting year, the time factor will be 6/12 and so on. Moreover, the straight line basis does not factor in the accelerated loss of an asset’s value in the short-term, nor the likelihood that it will cost more to maintain as it gets older. An alternative to straight-line depreciation is the declining balance method, where the value of the asset is reduced by a percentage rather than a fixed amount.